US banks have closed more than 50 branches in just two weeks, as the march towards online banking continues to decimate local services.

Wells Fargo, Chase, and Fulton were among the banks who closed locations between August 19 and September 7.

Bank of America and Chase gave notice to close the most locations, notifying the regulator that they will shut a further twelve of their branches each.

Bank of America and Chase gave notice to close the most locations, notifying the regulator that they will shut a further twelve of their branches each.

Wells Fargo informed the Office of the Comptroller of the Currency (OCC) that it would be shuttering nine locations, and Fulton confirmed it would be closing seven.

The rest of the closures, which spanned from Arizona to New Jersey , were closed by First National Bank of Long Island, Flagstar, Moody, PNC, Santander, UMB and Zions Bancorporation.

Scroll down for the full list with addresses. The closures were confirmed to the OCC, which monitors branch closures and openings and publishes them in a weekly bulletin.

Major banks are increasingly moving away from expensive brick-and-mortar branches in favor of online services.

‘Survey data continues to show that online banking is quickly becoming the standard for how people bank,’ Lead Data Content Researcher at GoBankingRates, Andrew Murray, told DailyMail.com following the latest figures.

CLICK HERE TO READ MORE FROM THE REPUBLICAN VOICE

‘Most Americans find it more convenient than having to go into a bank on a lunch hour or early in the weekends, and as more adults who grew up with smartphones enter the market, its popularity will continue to grow,’ Murray explained.

A recent GoBankingRates survey found that nearly 70 percent of customer between 25 and 34 preferred to do their banking online rather than in branch.

A recent GoBankingRates survey found that nearly 70 percent of customer between 25 and 34 preferred to do their banking online rather than in branch.

Researchers found that even seniors prefer online banking to in-branch services.

Experts advise those switching to online services to take advantage of bank’s support services offered to help with the transition.

‘Even though mobile banking is considered more of a self-service style, features like online chat support are frequently offered to assist you if you need help,’ Jessica Morgan, financial expert and founder of Canadian Budget said.

‘Even though mobile banking is considered more of a self-service style, features like online chat support are frequently offered to assist you if you need help,’ Jessica Morgan, financial expert and founder of Canadian Budget said.

Morgan said that online banking can help consumers save money as many online-only banks offer lower or even no fees at all, and can offer higher interest rates on savings since they do not have the same overhead costs of running bricks-and-mortar branches.

‘Most new online banks must work harder to compete for your business, frequently offering low to no fees, unlimited transactions and higher interest rates.

‘Most new online banks must work harder to compete for your business, frequently offering low to no fees, unlimited transactions and higher interest rates.

Using a bank you access from your phone can save you up to a few hundred dollars a year in account fees,’ she explained.

Indeed closures can lead to significant savings for traditional banks since the average freestanding bank branch costs around $2.6 million a year to run.

Indeed closures can lead to significant savings for traditional banks since the average freestanding bank branch costs around $2.6 million a year to run.

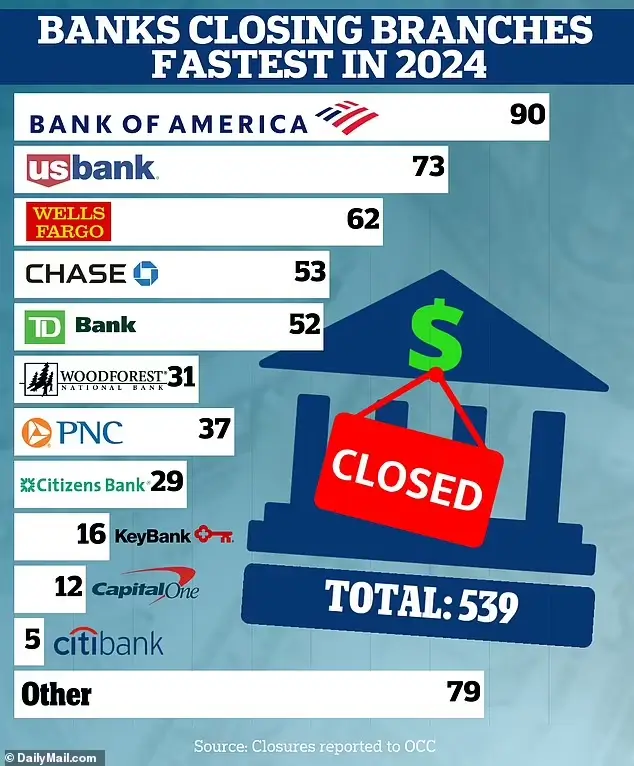

US banks shut 539 branches in just the first half of the year, research by DailyMail.com shows. The worst hit state was California, which saw 72 closures.

New York was second with 51 closures, followed by Pennsylvania at 40.

‘Over the last several years, we have rightsized our branch network, and we may continue to combine two older existing branches into one better situated location,’ Wells Fargo told DailyMail.com.

‘Over the last several years, we have rightsized our branch network, and we may continue to combine two older existing branches into one better situated location,’ Wells Fargo told DailyMail.com.

CLICK HERE TO READ MORE FROM THE REPUBLICAN VOICE

‘Doing so does not take away the importance of our customers and the communities we serve.’ US bank also highlighted clients’ migration towards online banking and ‘desire for greater simplicity’ as reasons for their mass closures.

‘As we evolve along with our clients, we are reevaluating our physical footprint, and in some instances, consolidating branch locations in select markets,’ the bank said in a statement earlier this year.

source: dailymail.co.uk/Major-banks-closed-55-branches-just-two-weeks